R&D Tax Credits Explained

What are R&D Tax Credits?

The R&D tax credit scheme is a UK tax relief scheme to promote R&D. It supports companies that are investing in innovation. It helps companies to grow and it turn the overall economy. Since the inception of the scheme in 2000 over £26 billion has been claimed and it is growing year on year.

You are able to make a claim in your CT600 and you support this by sending an R&D report to HMRC, which they aim to process the claims in 40 days. You are allowed to claim for the previous two accounting periods. Once you pass the deadline it is gone and you can never get it back. You can make a claim even if the project failed and you can potentially claim back 20% of qualifying expenditure.

To be eligible there is a shortlist of qualifying criteria:

- Be a UK limited company

- Be subject to normal UK corporation tax

- Have spent money on qualifying R&D

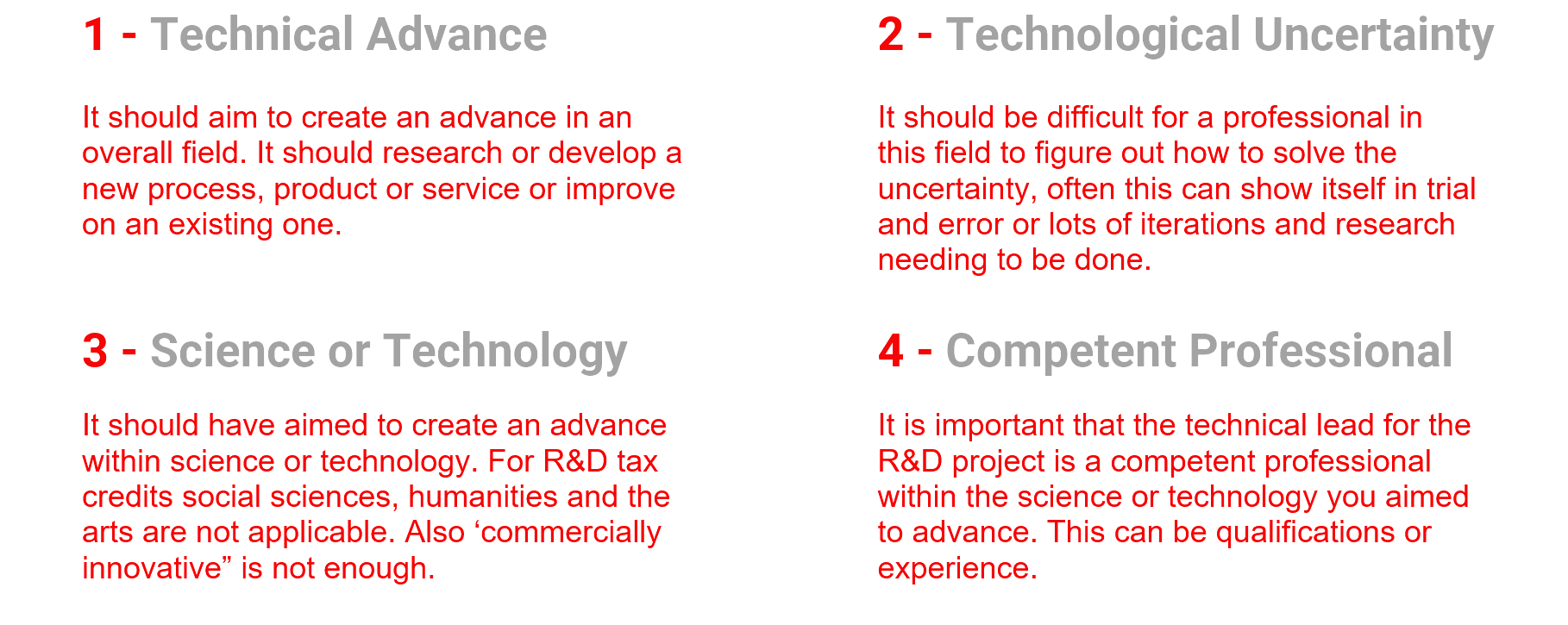

What is Qualifying R&D?

HMRC has strict definitions of what is R&D for the R&D tax credits scheme. They can be very complicated with a lot of “grey” areas, which is why it is advised to have a specialist aid you with this. In short, HMRC considers R&D “Work that advances overall knowledge or capability in a field of science or technology, and projects and activities that help resolve scientific or technological uncertainties, may qualify for R&D relief”

This can be broken down into certain things that must be met for HMRC to consider it R&D

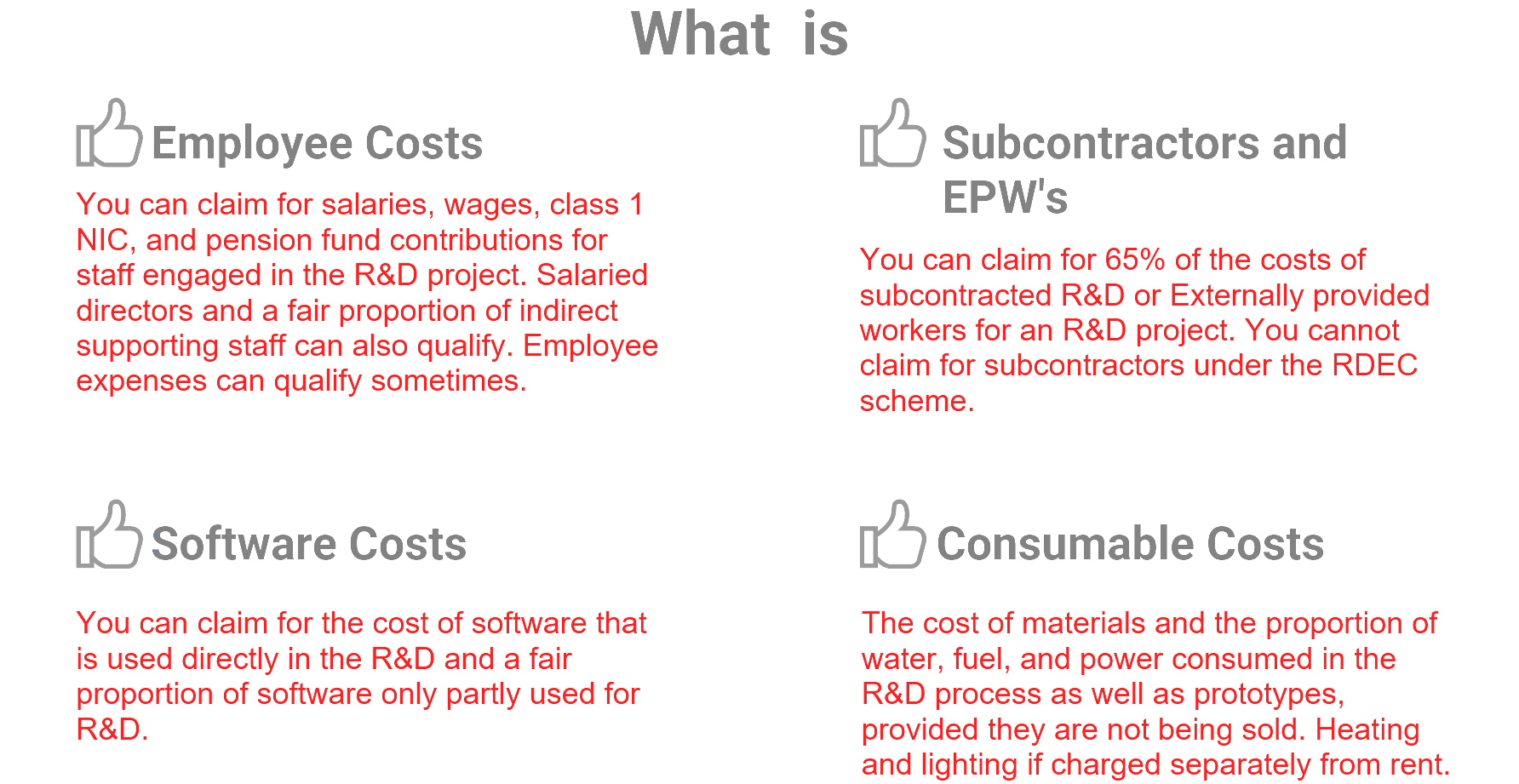

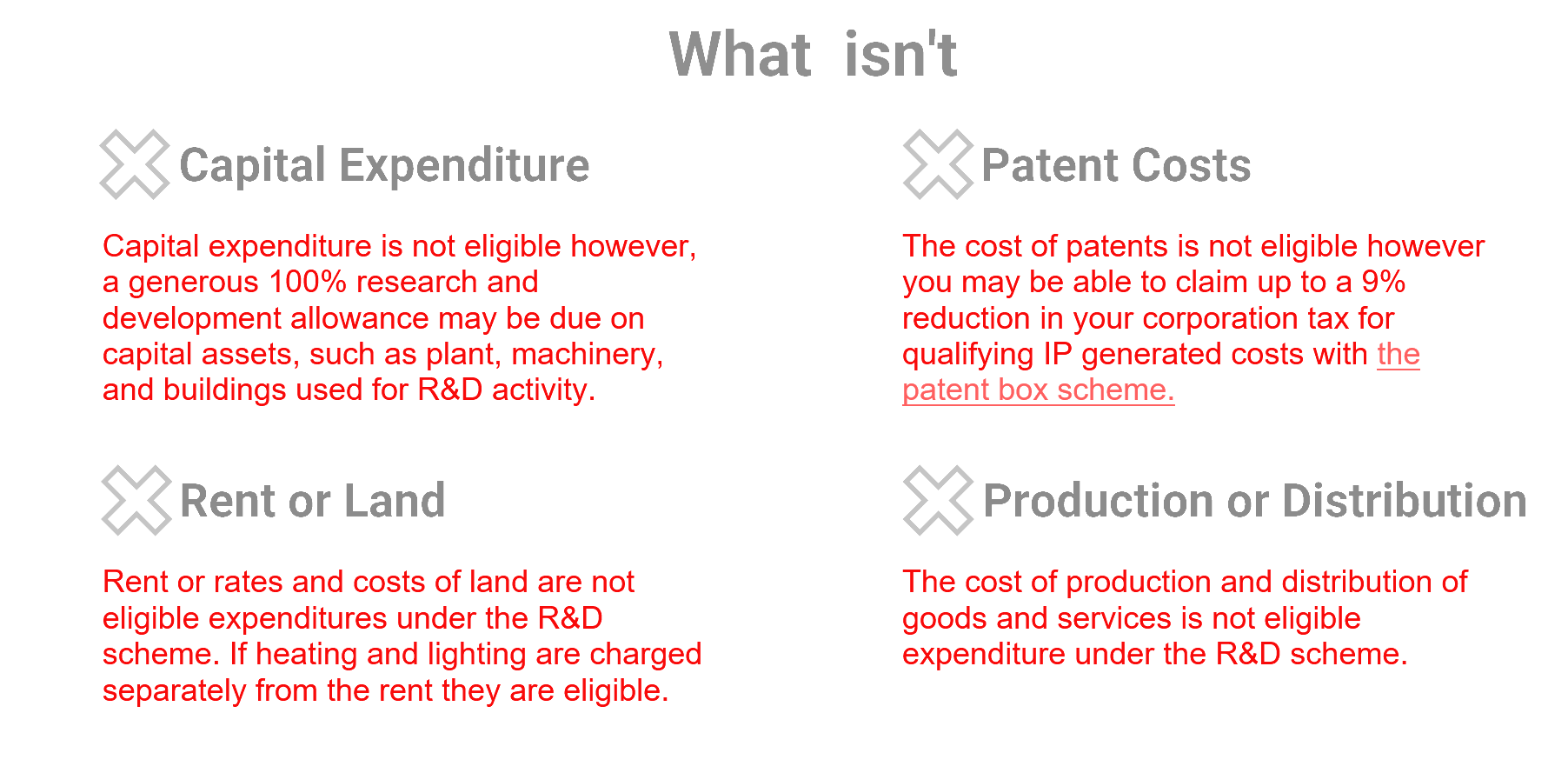

What is the Qualifying Expenditure?

The financial side of an R&D claim can be very complicated, and many different factors can affect what is and isn’t eligible, and what percentage is allowable. This is why we advise having a specialist aid you with an R&D claim. You are able to claim a lot of the costs associated with an R&D project. Below is a summary of what is and isn’t claimable.